LFL Partners | Live for Love

Connecting leading global Eating + Living (Hospitality) industry projects, capital, and ultra-high-net-worth individuals to empower partners toward structured growth and sustainable value creation.

Sister Company

Konghe Capital

Founded by the Saba Family, Konghe Capital specializes in connecting hotel light and heavy assets across top 111 global wellness and spiritual destinations with ultra-high-net-worth individuals and institutional investors.About Us

Founded in 2020, LFL Partners is a global investment and transaction advisory firm specializing in the Eating + Living (Hospitality) industries.

Leveraging deep international capital networks and industry resources, we connect high-quality projects with strategic investors, institutional capital, and ultra-high-net-worth individuals — supporting global expansion and long-term value creation.

Since July 2024, LFL has transitioned from private operations to public engagement, focusing on core transaction services and offering customized, flexible private deal structures.Milestones

Nov 2020|Global primary market research — covered 12,000+ financial investors and 1,200+ strategic capital partners.

Jul 2024|Global secondary market research — focused on 3,000+ LPs and UHNWI (AUM ≥ $1Bn), covering 7,000+ secondary participants.

Nov 2024|Comprehensive China market research — covered 1,000+ leading enterprises.

Jan 2025|Industry deep dives in green/recycling, real estate & engineering design, hospitality & dining, wellness & travel, and smart manufacturing.

Mar 2025|Focused on global Eating + Living (Hospitality) transactions — including food recycling tech, restaurant chains, green buildings, distribution platforms, and hotel assets.

Core Strengths

- Global Capital & Industry Integration: Connecting partners with strategic, financial, and commercial resources worldwide to drive cross-market collaboration and growth.

- Full-Chain Strategic & Sustainability Advisory: Mapping industry ecosystems and trends to guide forward-looking, sustainable development strategies.

- Tailored Post-Investment Empowerment: Designing customized value-creation programs for management teams to enhance long-term enterprise and asset value.

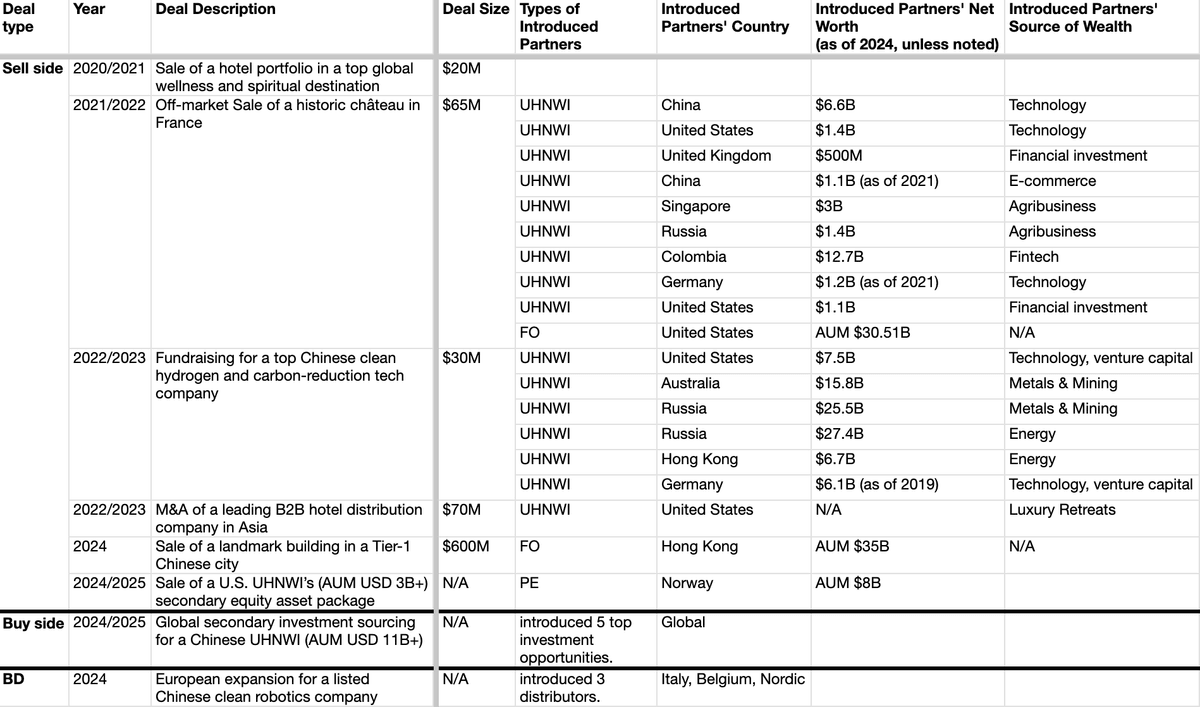

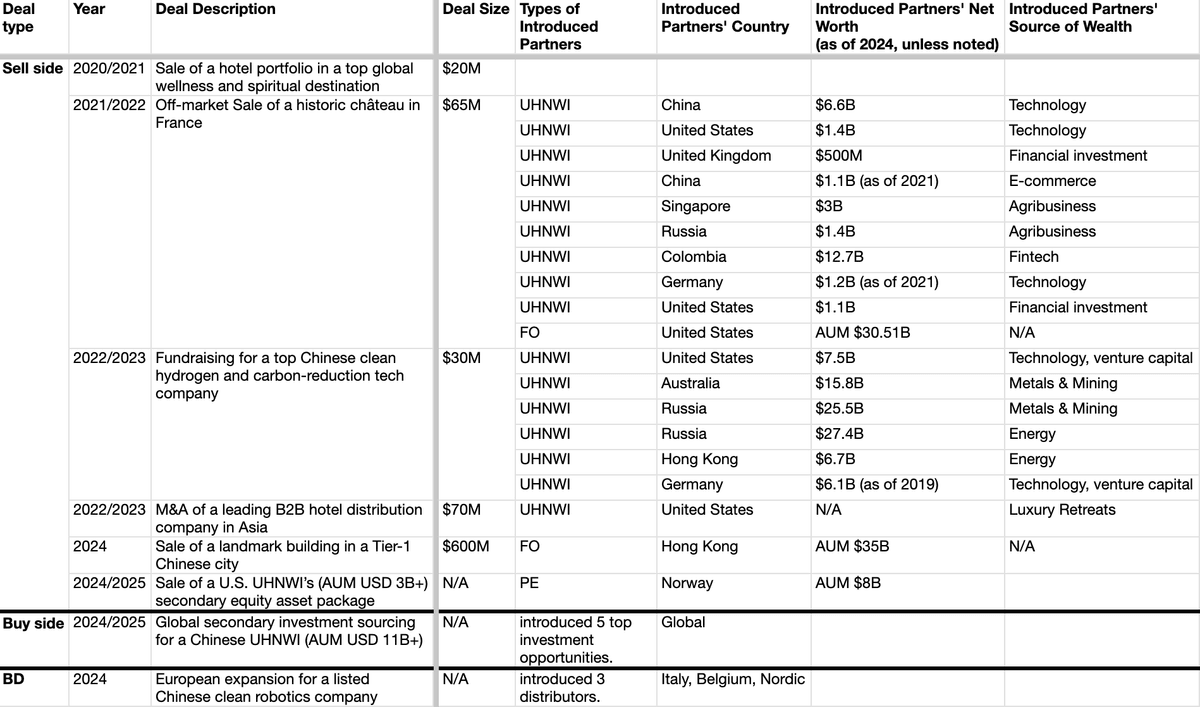

Select UHNWI Case Highlights

- Sale of a hotel portfolio in a one of top global wellness and spiritual destination — US$20M (2020/2021)

- Sale of a French heritage château — US$65M (2021/2022)

- Financing for a Chinese hydrogen reduction technology firm — US$30M (2022/2023)

- Acquisition of a leading Asian hotel distribution B2B platform — US$70M (2022/2023)

- Landmark building transaction in a Tier-1 Chinese city — US$600M (2024)

- European market expansion for a listed Chinese robotics firm — (2024)

- Secondary equity portfolio sales for a US UHNWI (AUM US$3B+) — (2024/2025)

- Global LP position and secondary equity allocation for a Chinese UHNWI (AUM US$11B+) — (2024/2025)

Cumulative UHNWI AUM connected: US$131B+ Total transaction volume: Over US$900M

LFL Partners provides resource introductions and business advisory services exclusively. We are not a licensed broker, dealer, or placement agent. LFL Partners disclaims all liability for any decisions, outcomes, or fund movements resulting from our introductions. We do not verify or guarantee the licensing, qualifications, financial standing, or suitability of any third parties introduced through our services. All introductions are provided on a best-effort basis and should not be interpreted as endorsements, recommendations, or guarantees. Clients are solely responsible for conducting their own due diligence to assess the risks of potential partners, transactions, or investments. LFL Partners strongly advises clients to seek independent accounting, legal, and tax advice before entering into any agreements or commitments. By using this website or engaging with LFL Partners' services, you acknowledge that you do so at your own risk. LFL Partners assumes no responsibility for the accuracy, completeness, or reliability of any information shared or the outcomes of introductions made. Your use of this website or LFL Partners' services constitutes your full acceptance of our Privacy Policy and these terms. LFL Partners reserves the right to update these terms at any time without prior notice.

© 2025 LFL Partners. All rights reserved.